StreamSwap Protocol

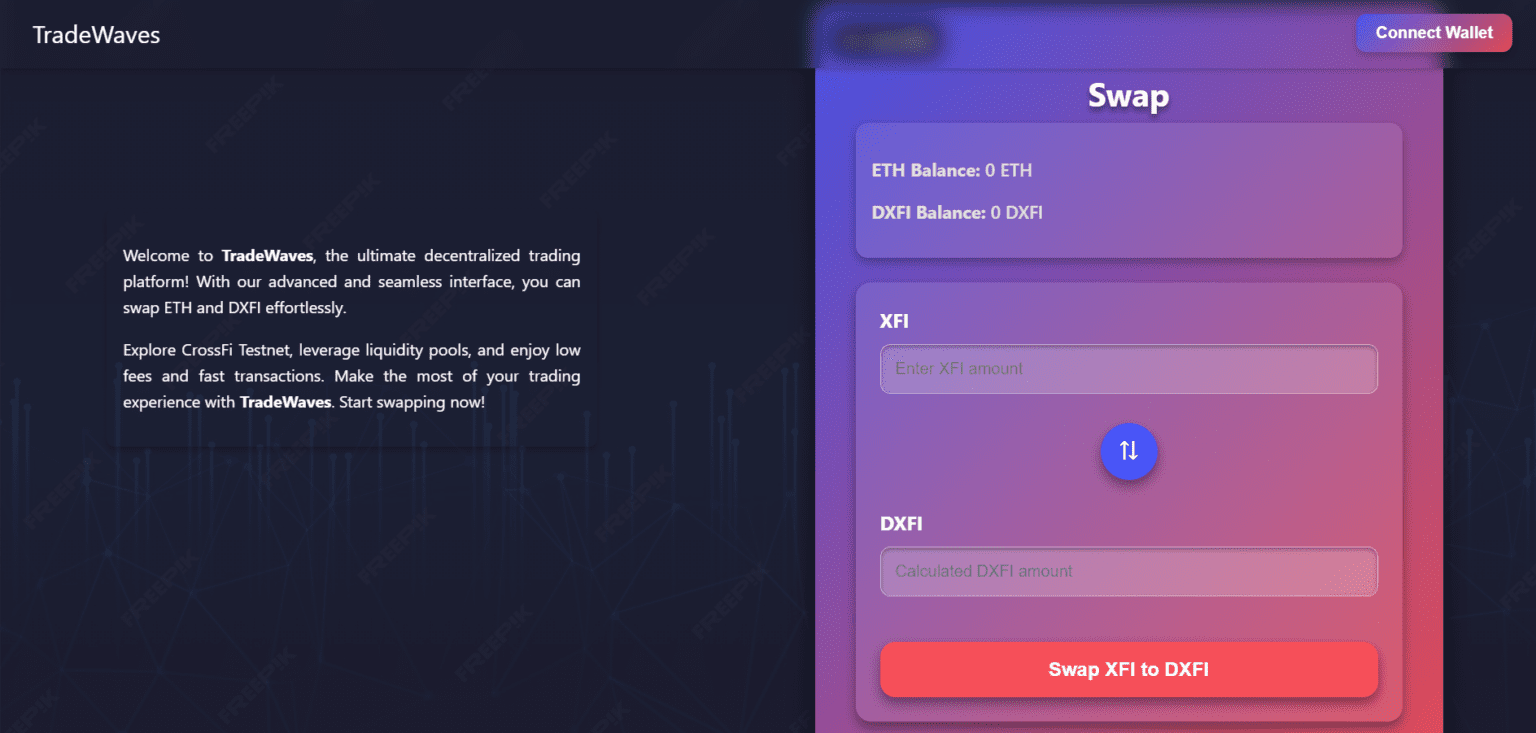

It is a high-speed, gas-efficient Automated Market Maker (AMM) built for the CrossFi Mainnet. It uses a stream-based liquidity algorithm to ensure instant swaps, dynamic pricing, and low gas costs, ideal for high-frequency traders. With features like scalable trade execution, customizable fee models, and real-time liquidity adjustments, StreamSwap aims to revolutionize token trading. The $1k XFI funding will support its deployment, fostering greater DeFi adoption and liquidity across the ecosystem.

High-Speed Trading Meets Smart Liquidity

StreamSwap Protocol is an advanced Automated Market Maker (AMM) built for speed, gas efficiency, and scalability. Leveraging a stream-based liquidity algorithm, it optimizes swap execution with minimal slippage and latency. Designed for both retail and high-frequency traders, StreamSwap delivers frictionless token trading while drastically reducing gas costs. This next-gen AMM architecture positions itself as a game-changer in the DeFi space by eliminating traditional bottlenecks.

Scalable Swaps on the CrossFi Mainnet

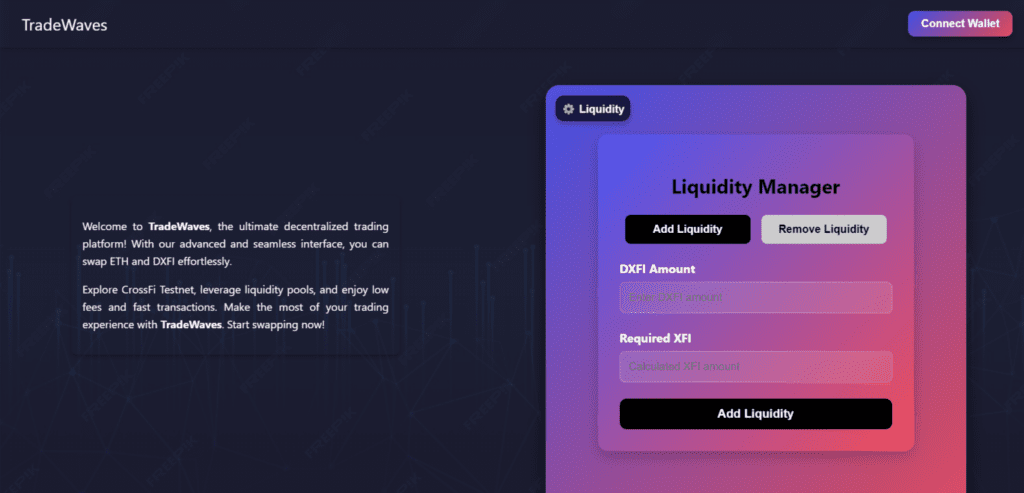

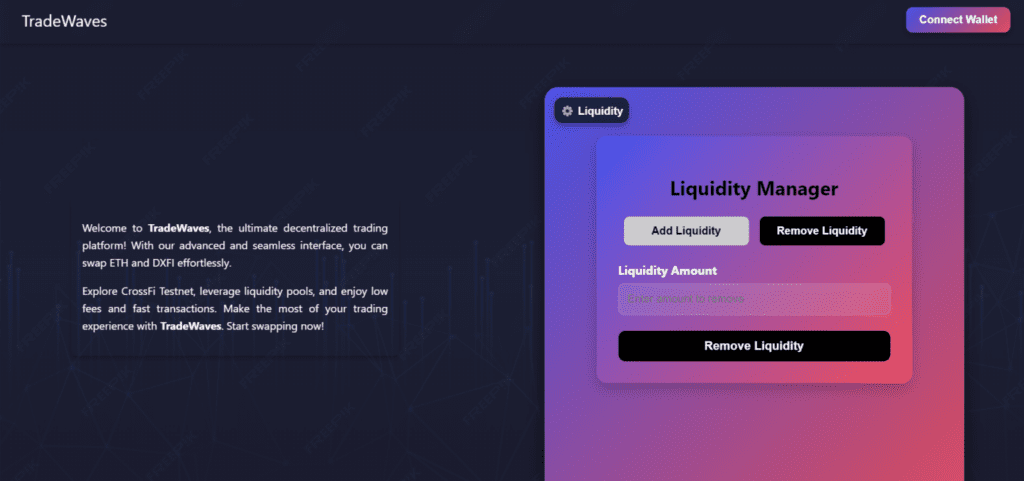

StreamSwap integrates with the CrossFi Mainnet to provide low-cost, high-speed swaps that scale with demand. Dynamic fee tiers reward liquidity providers based on contribution and activity, while smart routing ensures optimal trade paths. With features like encrypted pool data and transaction-level validation, the protocol ensures safe, transparent, and efficient trading. StreamSwap doesn’t just meet current DeFi standards—it sets a new one for the future.

🔹 Real-time liquidity rebalancing reduces slippage, maintains pool efficiency, and supports high-frequency trading even during volatile markets.

🔹 Built with optimized code to lower transaction costs, StreamSwap enables affordable trading for all users—especially those trading frequently.

🔹 Supports large transaction volumes with zero lag, incorporates pre-trade validation for safety, and allows LPs to define dynamic fee structures.