AquaDex AMM

It is a cross-chain Automated Market Maker platform designed to simplify token trading and liquidity provision within the CrossFi ecosystem and other EVM-compatible chains. It replaces traditional order books with liquidity pools to ensure low slippage, efficient trades, and inclusive access. Key features include cross-chain token swaps, liquidity farming, and secure, user-friendly interfaces. With a funding request of $1k XFI tokens, AquaDex aims to enhance DeFi participation through seamless trading, governance options, and future mobile and analytics integrations.

An Automated Market Maker (AMM) platform

AquaDex is an innovative Automated Market Maker (AMM) platform designed to address liquidity challenges and enhance decentralized trading across blockchain networks. Unlike traditional order book-based exchanges, AquaDex employs liquidity pools to facilitate seamless token swaps with minimal slippage. By leveraging cross-chain interoperability, the platform enables users to trade tokens effortlessly across CrossFi and EVM-compatible chains. AquaDex is not just a trading platform—it is a comprehensive liquidity management solution that empowers both traders and liquidity providers with user-friendly tools, transparent transactions, and efficient market operations. With the integration of audited smart contracts, real-time pricing mechanisms, and liquidity farming opportunities, AquaDex is set to become a pivotal player in the DeFi ecosystem, ensuring accessibility, security, and efficiency for all participants.

Revolutionizing Liquidity Provision in the CrossFi Ecosystem

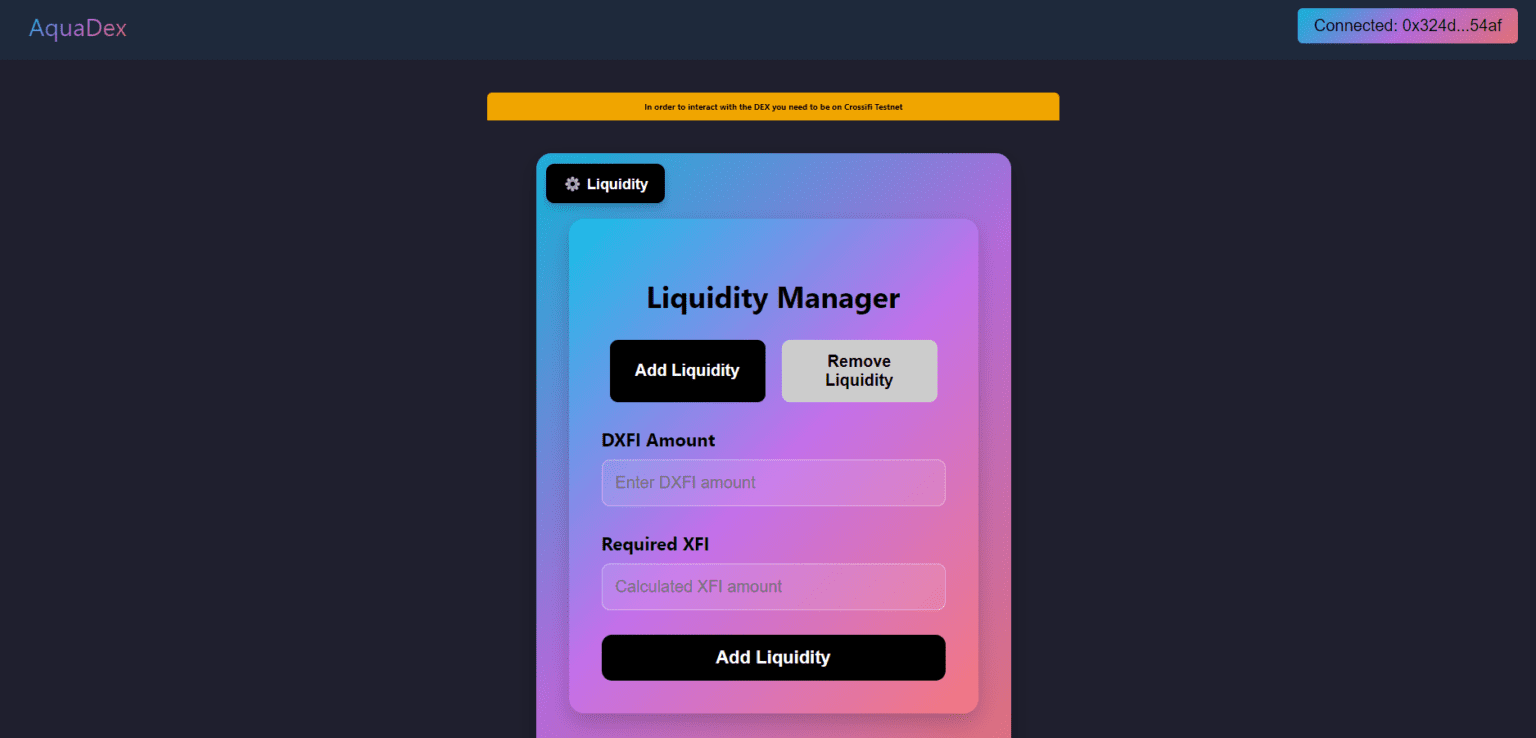

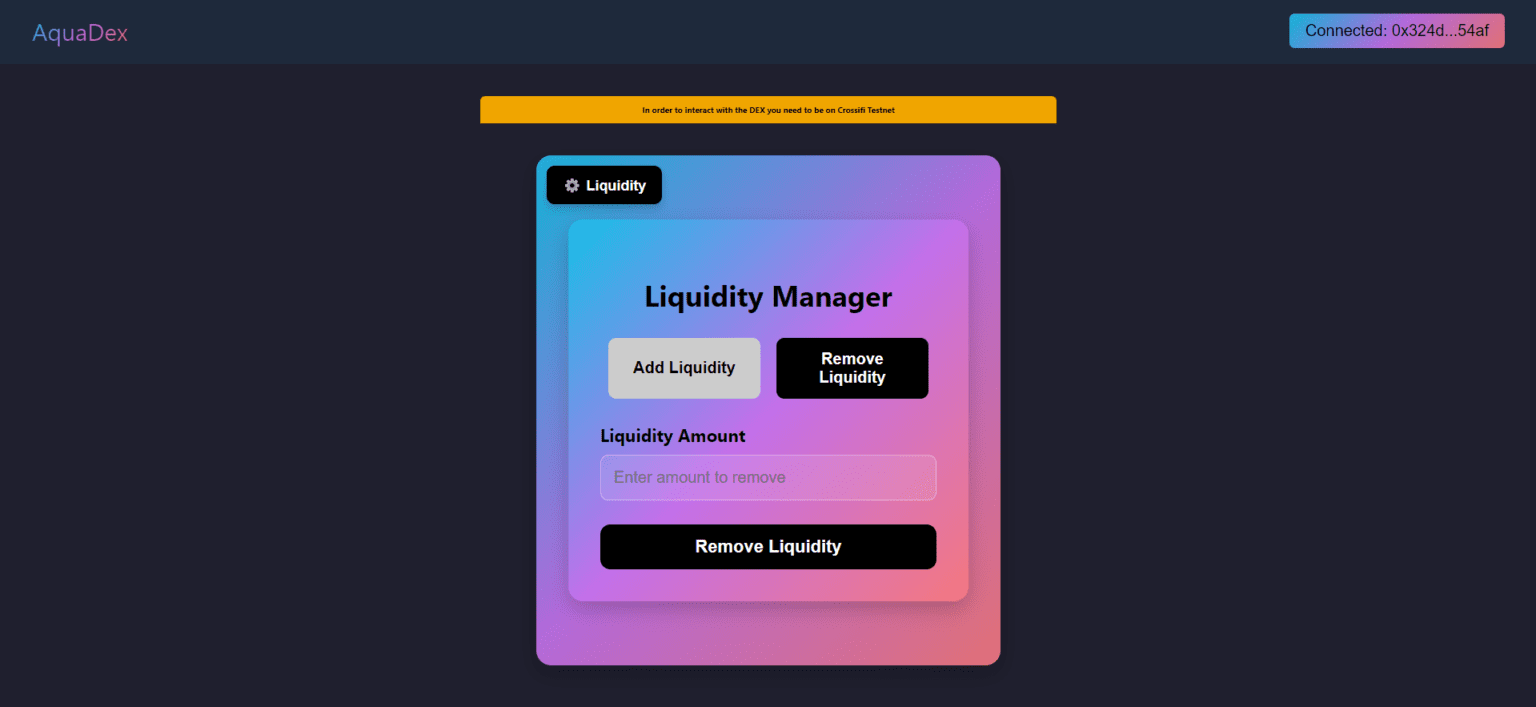

Liquidity fragmentation and inefficient trade execution have long been barriers to mainstream DeFi adoption. AquaDex aims to bridge these gaps by offering an intuitive and efficient liquidity management system. Users can seamlessly add or remove liquidity while earning incentives in the form of transaction fees and farming rewards. The platform’s cross-chain capabilities eliminate interoperability challenges, allowing for smooth asset transfers between networks. Security remains a top priority, with robust smart contract audits and tools to monitor impermanent loss, ensuring a safe and transparent trading environment. AquaDex is committed to continuous innovation, with planned enhancements like governance integrations, multi-chain expansion, and mobile accessibility to further elevate the DeFi trading experience.

🔹 AquaDex facilitates seamless cross-chain token swaps, allowing users to trade assets across CrossFi and EVM-compatible blockchains without relying on centralized intermediaries.

🔹 The platform utilizes automated liquidity pools, ensuring efficient trading by dynamically adjusting pool balances and providing real-time price discovery for token swaps.

🔹 With an optimized AMM model, users experience minimal slippage, ensuring better trade execution rates and a more cost-effective trading experience compared to traditional DeFi exchanges.

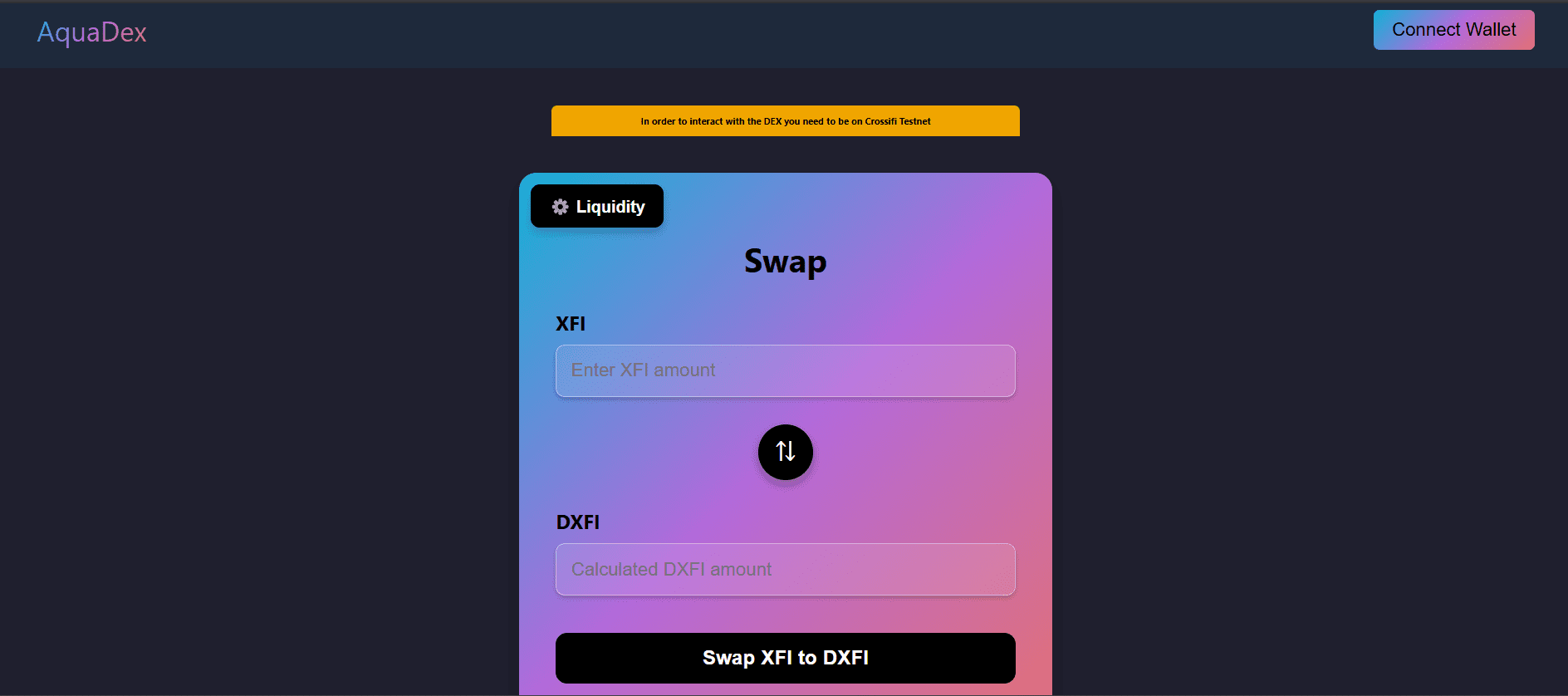

🔹 The user-friendly and intuitive interface simplifies trading and liquidity management, making the platform accessible to both beginners and experienced DeFi users.

🔹 AquaDex implements audited smart contracts to enhance platform security, ensuring trust and preventing vulnerabilities that could compromise user funds.

🔹 The platform offers complete transparency with its fee structures, allowing users to review and verify transaction costs before execution, eliminating hidden charges.

🔹 Liquidity providers have access to impermanent loss tracking tools, helping them assess potential risks and make informed decisions when adding or removing liquidity.

🔹 Decentralized infrastructure ensures that all transactions are processed securely on-chain, reducing risks of manipulation and increasing overall system integrity.

🔹 Users who provide liquidity earn rewards in the form of transaction fees and incentive tokens, making liquidity provision both beneficial and sustainable.

🔹 The system automates fee distribution, ensuring that liquidity providers receive their earnings promptly and fairly based on their contribution.

🔹 Future updates will introduce staking and yield farming opportunities, allowing users to maximize returns on their assets.

🔹 Liquidity providers have full flexibility to add or withdraw assets at any time, with no unnecessary restrictions, ensuring easy fund management.

🔹 Governance mechanisms will be introduced, allowing token holders to vote on fee structures, pool configurations, and future feature implementations.

🔹 AquaDex aims to expand support for additional blockchain ecosystems, increasing interoperability and liquidity reach across multiple networks.

🔹 Advanced DeFi features such as staking and yield farming tools will be integrated to enhance user engagement and earning opportunities.

🔹 A dedicated mobile application will be launched, ensuring seamless trading and liquidity management from anywhere, anytime.