YieldX

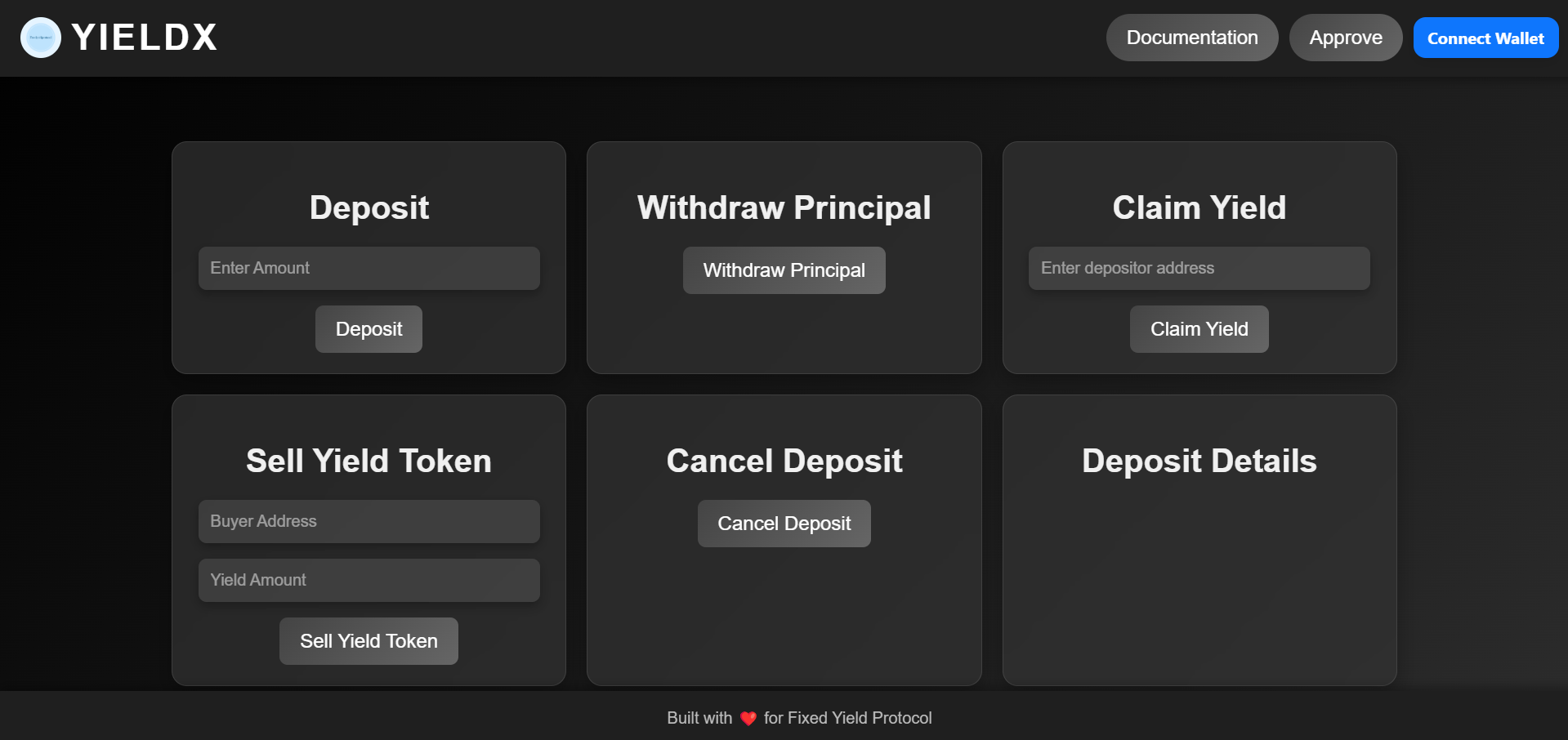

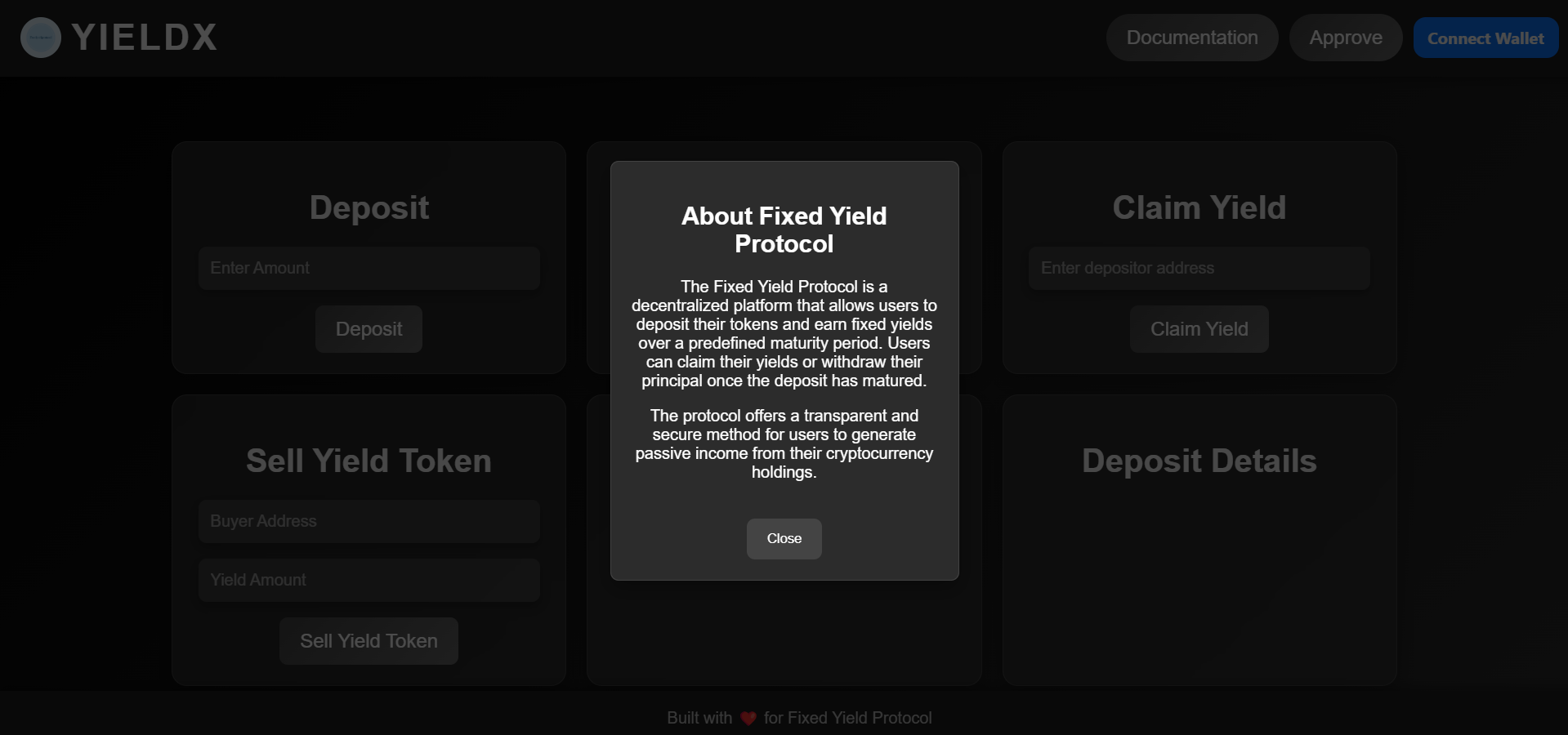

It is a decentralized finance (DeFi) protocol that allows users to tokenize and trade future yield by separating asset ownership into Principal Tokens (PT) and Yield Tokens (YT). With a fixed 60-day maturity and 10% interest rate, users can earn fixed income or speculate on yield. The platform supports yield trading, principal withdrawal, and early cancellation, all while maintaining transparency and security. A 1% fee applies to Yield Token trades, and all actions are managed via smart contracts.

YieldX: Tokenizing Future Yield in DeFi

YieldX revolutionizes decentralized finance by allowing users to tokenize and trade the future yield of their deposits. Through an innovative dual-token model—Principal Tokens (PT) and Yield Tokens (YT)—YieldX decouples asset ownership from its yield, opening up new possibilities for fixed-rate income and yield speculation. This protocol ensures transparency, predictability, and user control over their earnings by introducing a fixed 60-day maturity period and a 10% interest rate, all governed by smart contracts.

Security, Utility & Flexibility at its Core

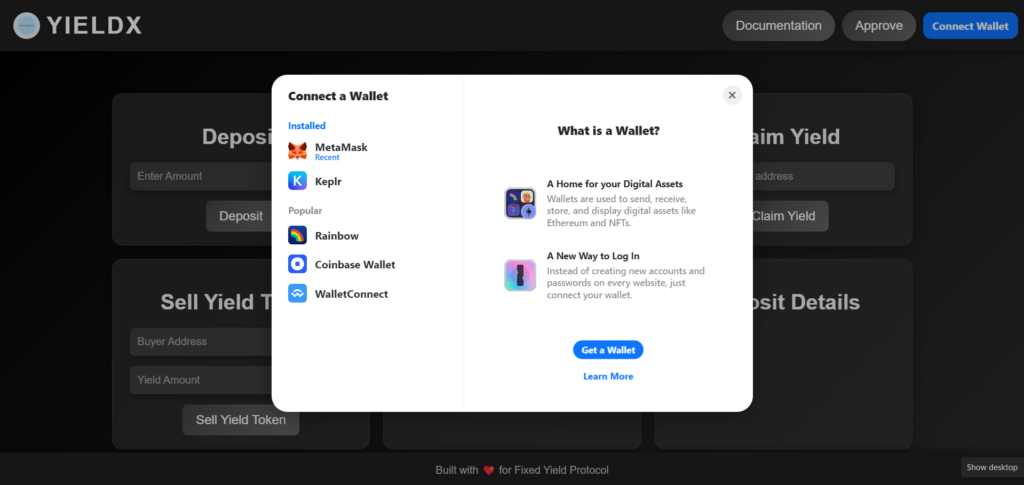

The YieldX ecosystem prioritizes secure, modular smart contract design while offering users comprehensive control over their deposits. Features like pre-maturity cancellation, token trading, and fee adjustments by admins provide a dynamic yet stable experience. Combined with wallet integration through the Rainbow Wallet, a dashboard for real-time interaction, and robust functions for deposit management, YieldX stands out as a transparent and flexible solution for managing decentralized yield.

🔹 Deposits are split into Principal Tokens (PT) and Yield Tokens (YT)

🔹 Enables users to separate asset ownership from its future yield

🔹 PT represents the original deposit, while YT represents future interest

🔹 Tokens are tradable or redeemable after a 60-day maturity

🔹 Users can claim fixed 10% EDU yield after maturity using YT

🔹 YT can be sold before maturity to speculate on future yield

🔹 1% transaction fee applies to every YT trade

🔹 Enables earning fixed-rate income or participating in market-driven trading

🔹 Users deposit native tokens and receive PT and YT instantly

🔹 Principal can be withdrawn after 60 days by burning PT

🔹 Deposits can be canceled before maturity if YT are untouched

🔹 Cancellation burns both PT and YT, returning original native tokens

🔹 Admins can update transaction fees (default is 1%)

🔹 Utility functions let users view deposit details and calculate yield

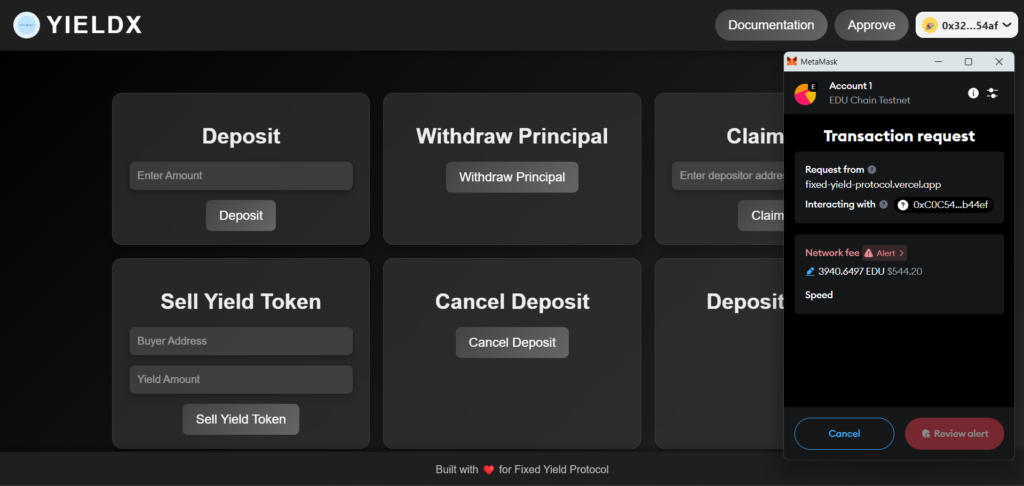

🔹 All major functions like deposit, withdraw, sell, claim, and cancel are smart contract-based

🔹 Events are emitted for every action to ensure transparency

🔹 All interactions are recorded and traceable via on-chain events

🔹 Users are encouraged to monitor the 60-day maturity period

🔹 System design avoids automatic penalties—flexibility is prioritized

🔹 Contract should be audited before deployment for maximum security