Result

How We Helped a National Insurance Provider Identify $4.2M in Fraud—And Cut Investigation Time by 68%

Client Overview

Goal

Problem

▫️ Fraudulent claims were slipping through due to siloed systems and limited historical analysis

▫️ Investigators spent weeks manually reviewing low-risk claims

▫️ Patterns of coordinated fraud were rarely surfaced until after payouts

▫️ False positives created unnecessary costs and legal headaches

Solution

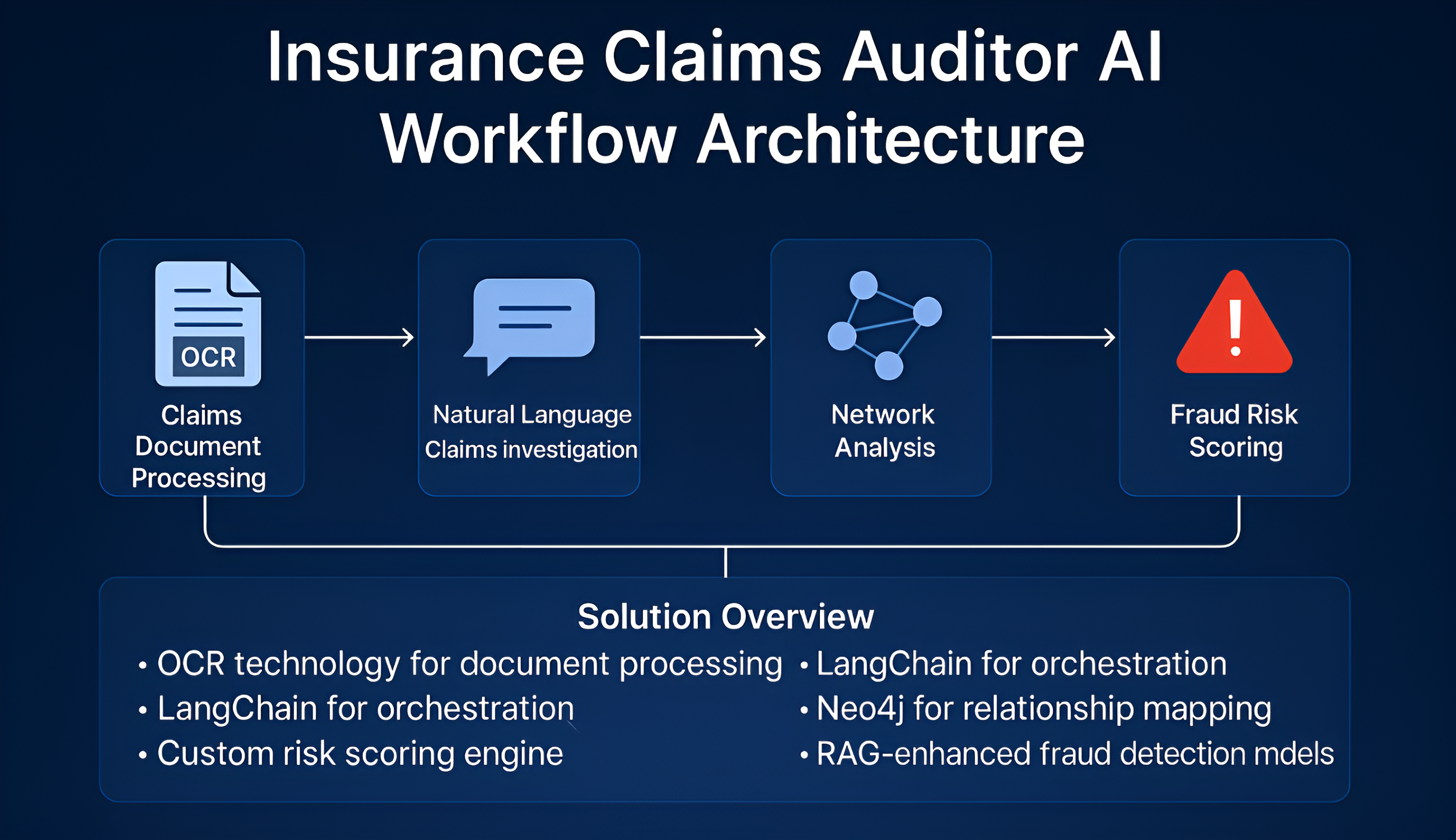

TechSteck Solutions built an AI-powered Claims Auditor—an advanced RAG-based fraud detection system that parses documents, analyzes relationships, and flags risk with source-cited explanations. It combines OCR, graph analysis, and machine learning to spot fraud faster and smarter

▫️ OCR engine for document digitization and structured extraction

▫️ LangChain for orchestration and natural language interface

▫️ Neo4j for graph-based network analysis

▫️ Custom fraud risk engine with ML-based scoring

▫️ GPT-powered RAG models for real-time question answering

How It Works

Conclusion

By combining OCR, network analysis, and advanced risk scoring, TechSteck Solutions gave this insurer a proactive fraud detection system that improves over time, surfaces previously invisible risks, and slashes wasted time on low-risk claims—turning compliance into a competitive advantage.

Contact Us

©2025 | Techststeck Solutions