RESULT

THE CLIENT

A stealth-mode cross-chain derivatives platform backed by top DeFi hedge funds and Web3 foundations. Their vision: unlock global liquidity for perpetuals trading — without fragmenting capital across chains.

THE PROBLEM

OUR SOLUTION

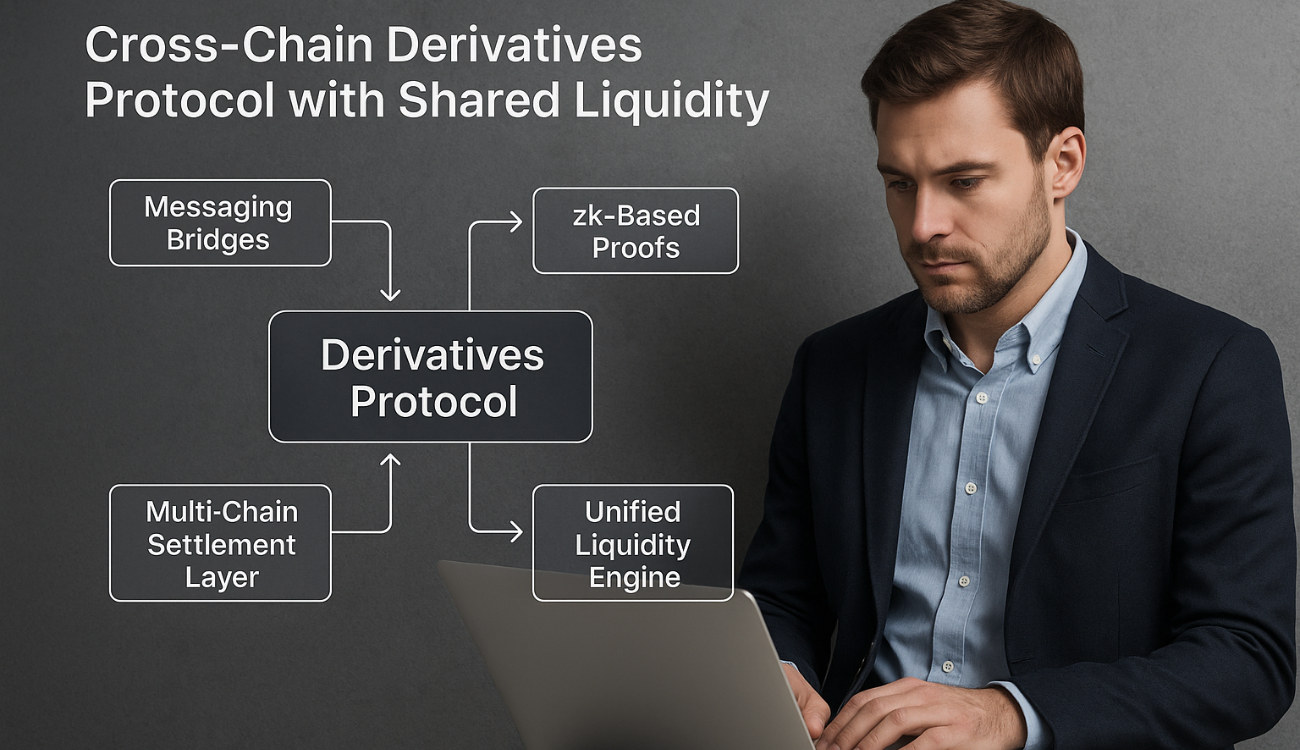

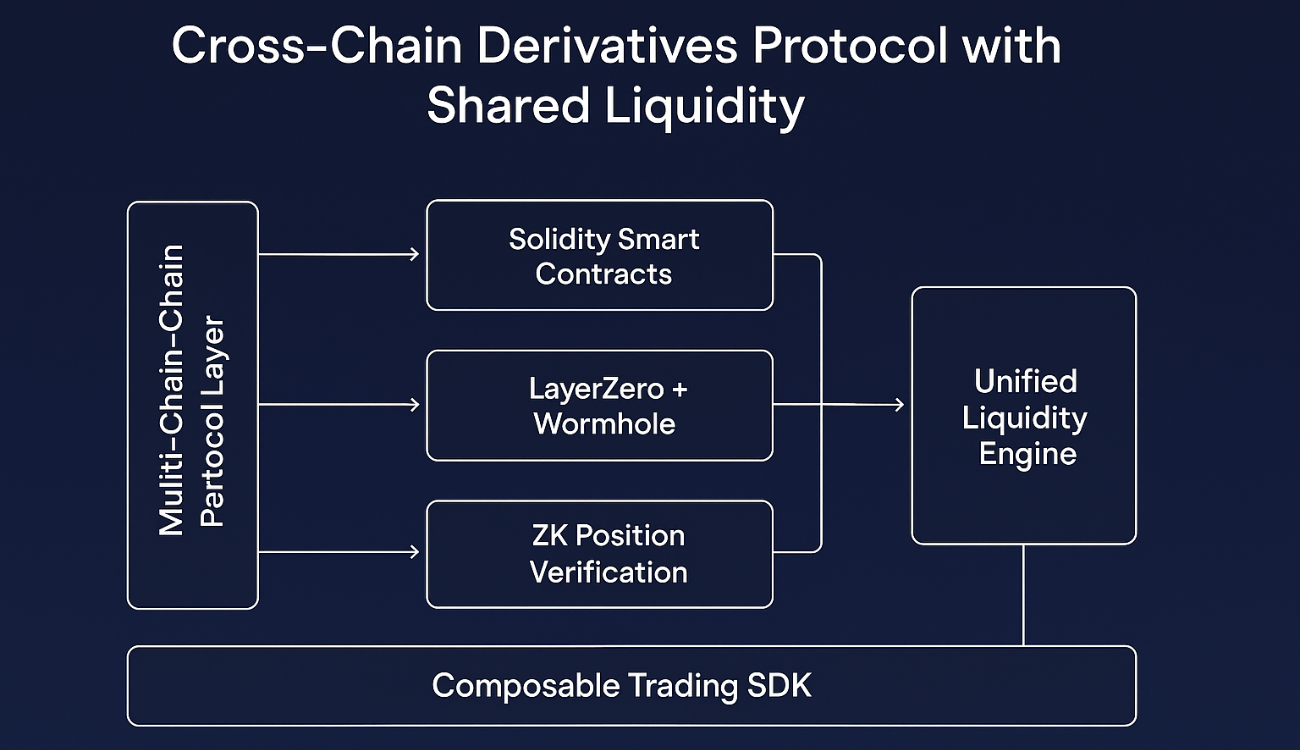

We engineered a modular, zk-secured perpetuals protocol with true cross-chain settlement, unified liquidity, and blazing-fast finality.

Key Systems We Integrated:

▫️ Solidity smart contracts for trade, margin, and liquidation logic

▫️ LayerZero & Wormhole for cross-chain liquidity sync and messaging

▫️ zkSNARKs for secure off-chain trade verification

▫️ SDK for DeFi aggregators to plug in natively

BOTTOM LINE

Contact Us

©2025 | Techststeck Solutions