LendX Protocol

It is a decentralized, smart contract-based lending platform that allows borrowers to obtain loans without collateral and lenders to earn interest on fixed deposits (30, 90, 180 days). It features late fee handling, an insurance pool for defaults, and a borrower blacklist system. The owner can manage rates, recover defaulted funds, and control user access. Future plans include dynamic interest rates, customizable loan periods, and cross-chain expansion.

LendX: Decentralized Lending and Borrowing Without Collateral

LendX is a decentralized finance (DeFi) protocol that enables users to lend and borrow cryptocurrency in a trustless environment. Unlike traditional lending systems, LendX allows borrowers to request loans without collateral, making credit more accessible while implementing strict risk management mechanisms such as blacklisting defaulters and maintaining an insurance pool.

Lenders deposit their funds for fixed lock periods (30, 90, or 180 days) and earn interest on their deposits. Borrowers, in turn, can request loans under defined terms, ensuring a fair and transparent ecosystem. The protocol also incorporates late fees for overdue payments and enables the owner to manage risk factors by recovering defaulted funds from the insurance pool.

How LendX Works: Loan Mechanism and Governance

The LendX Protocol operates through smart contracts that govern lending, borrowing, and risk management. Lenders provide liquidity, and borrowers access funds under predefined conditions. If a borrower fails to repay on time, late fees are applied, and persistent defaulters are blacklisted from the system.

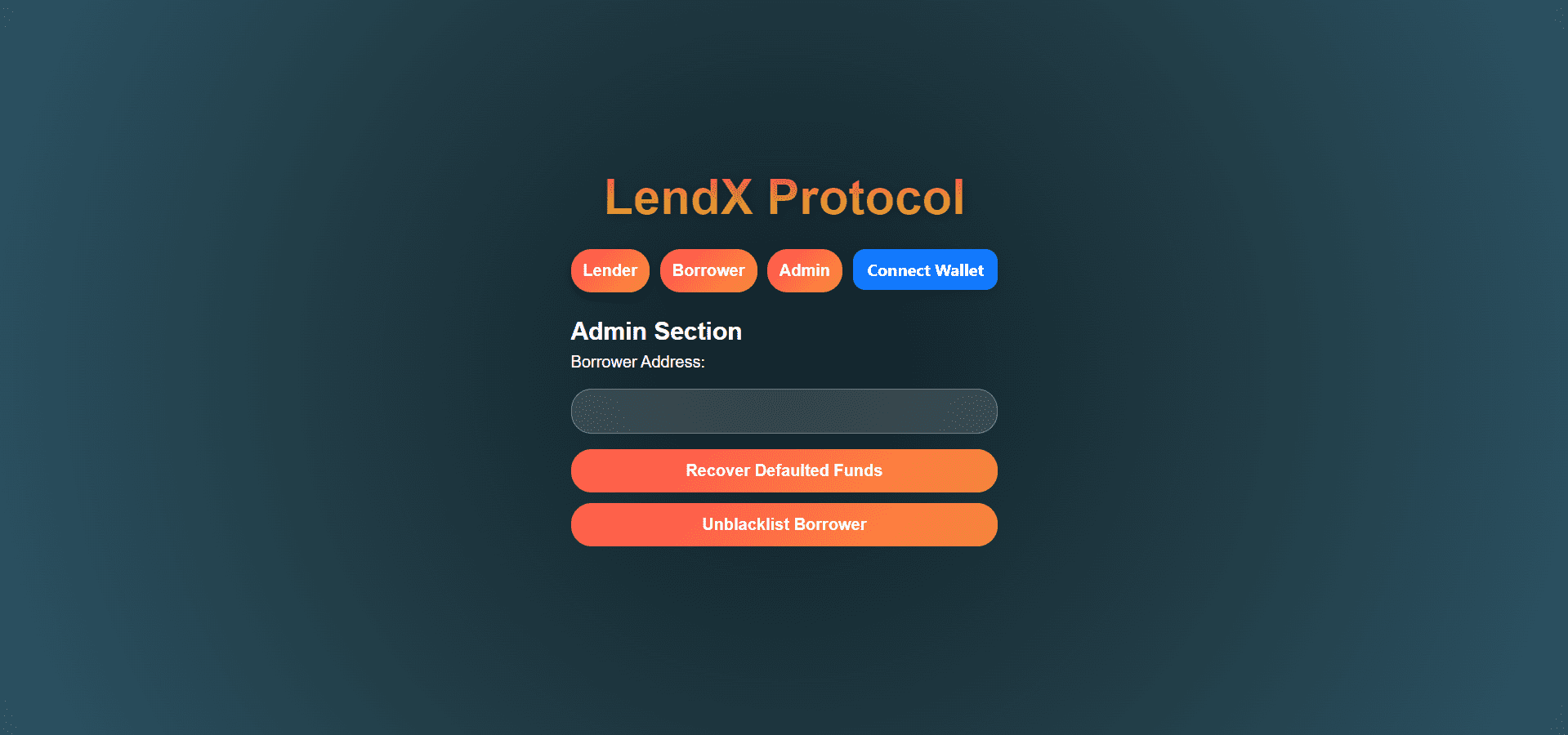

To enhance security, LendX maintains a 2% insurance pool from each loan transaction, ensuring lenders are protected against defaults. The admin role is responsible for monitoring defaulters, unblacklisting borrowers, and adjusting interest rates based on market conditions.

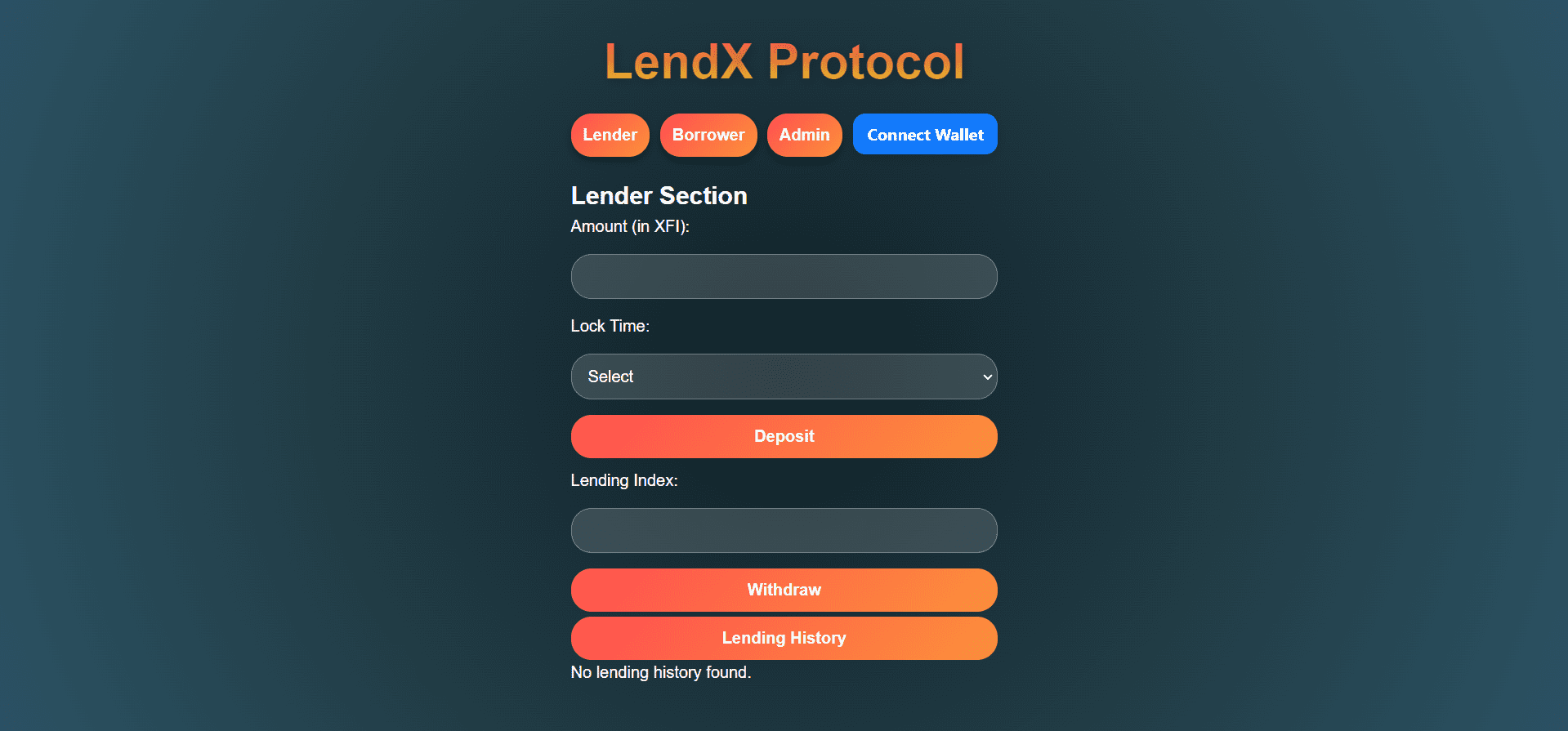

🔹 Lenders can deposit funds into the contract for fixed durations of 30, 90, or 180 days. The longer the deposit period, the higher the interest earnings.

🔹 Interest is automatically accrued based on the deposited amount and lock period, rewarding lenders for providing liquidity to the system.

🔹 Once the lock period is over, lenders can withdraw their funds along with accumulated rewards, ensuring a profitable lending experience.

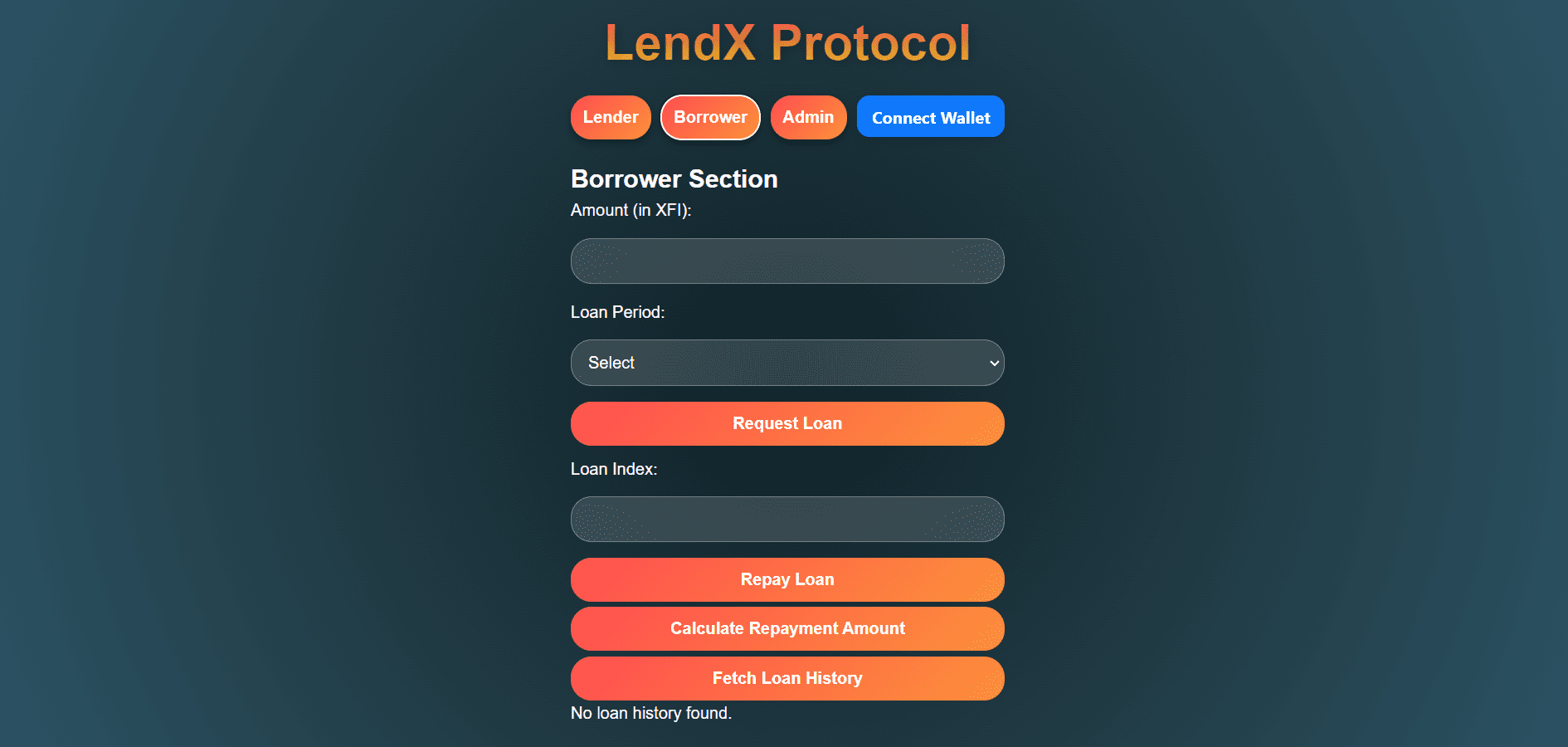

🔹 Borrowers can request loans without collateral, making credit more accessible to users who may not have assets to pledge.

🔹 Loan periods are available for 30, 90, or 180 days, allowing borrowers to choose a suitable repayment timeframe.

🔹 Borrowers must repay their loans along with interest before the due date. If repayment is delayed, late fees start accruing based on the overdue duration.

🔹 A late fee mechanism is in place, ensuring that overdue repayments incur additional charges to discourage defaults.

🔹 Borrowers who fail to repay loans repeatedly are blacklisted, preventing them from accessing future loans through the platform.

🔹 The protocol maintains an insurance pool, funded by a 2% fee from each loan, which helps recover losses from defaulted loans and protects lenders from potential financial risks.

🔹 The admin has the ability to unblacklist borrowers under special conditions, ensuring fair reconsideration for those who defaulted due to unavoidable circumstances.

🔹 Interest rates are adjustable by the owner, allowing modifications based on market trends to maintain a sustainable lending environment.

🔹 The insurance pool is managed by the admin, ensuring that defaulted loan recoveries are handled efficiently and fairly to protect the ecosystem.

🔹 Customizable loan durations will allow borrowers to select more flexible repayment periods, catering to different financial needs.

🔹 A dynamic interest rate system will be introduced, adjusting based on market demand and lending activity to maintain a balanced economy.

🔹 LendX plans to expand its services to multiple blockchain networks, enabling cross-chain lending and making decentralized credit available on a global scale.