FlexiStakeLoan

It is a DeFi smart contract enabling users to stake native tokens, borrow against staked collateral, and lend tokens to earn compounding rewards. It offers flexible loan terms (30, 90, 180 days) with interest rates up to 10% and includes automatic default handling through collateral forfeiture and borrower blacklisting. Stakers and lenders earn monthly and annual bonuses, while admins manage defaults and blacklist removals. The platform ensures a secure, transparent, and rewarding ecosystem for both borrowers and lenders.

FlexiStakeLoan: A Decentralized Lending & Staking Solution

FlexiStakeLoan is a Decentralized Finance (DeFi) smart contract that enables users to stake native tokens, borrow funds against their staked collateral, lend tokens for rewards, and manage loan repayments efficiently. The contract provides a structured and transparent financial ecosystem where both borrowers and lenders benefit from flexible loan terms and compounding rewards.

Borrowers can stake tokens to gain access to liquidity while earning staking rewards. Lenders contribute liquidity to the platform and receive interest-based rewards for their participation. The system enforces automated loan default handling through collateral forfeiture and borrower blacklisting, ensuring minimal risk for lenders.

How the Smart Contract Works: Loan, Subscription & Governance Model

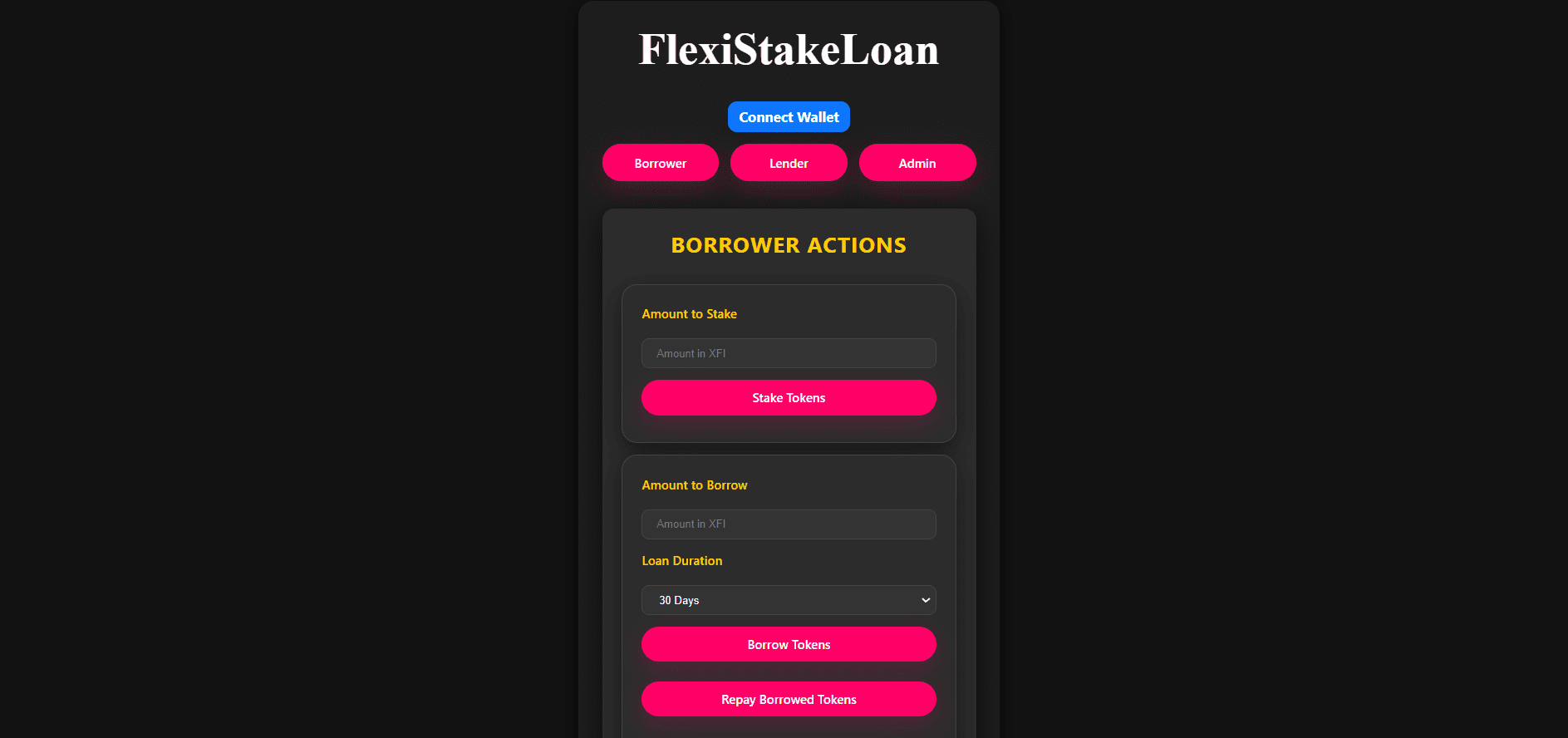

The FlexiStakeLoan smart contract operates on a staking-based borrowing system, ensuring users can access funds while securing loans with their own collateral. Borrowers stake native tokens and can borrow up to 50% of their staked amount for predefined durations of 30, 90, or 180 days. If a loan is not repaid within the specified period, the staked tokens are forfeited, and the borrower is blacklisted.

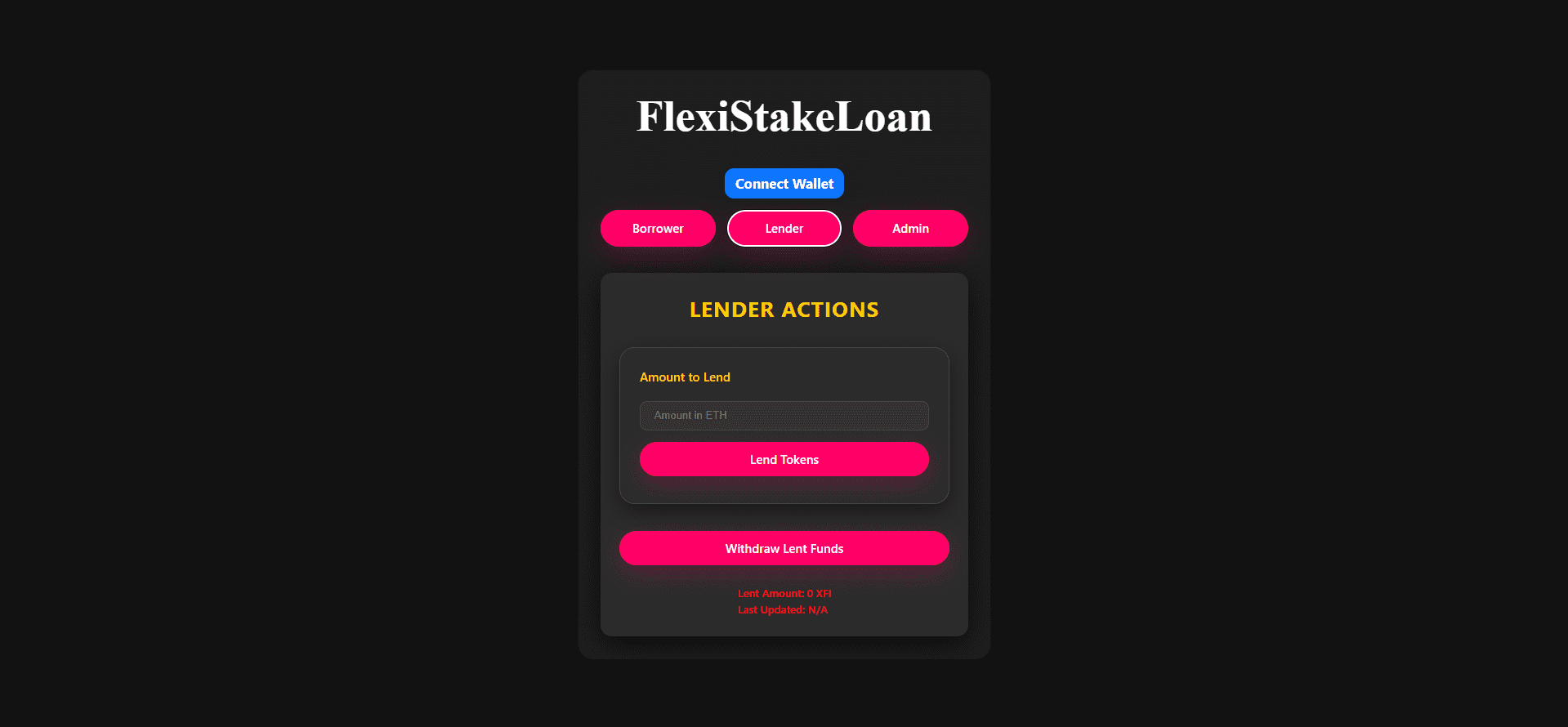

Lenders provide liquidity to the contract and earn rewards through compounding interest. The system is designed to be self-sustaining, rewarding both stakers and lenders with interest while maintaining risk mitigation mechanisms for defaulters.

🔹 Users stake native tokens to earn monthly and annual rewards.

🔹 Borrowers can take loans up to 50% of their staked collateral.

🔹 Loan durations are flexible:

▫ 30 days – 5% monthly interest.

▫ 90 days – 7% monthly interest.

▫ 180 days – 10% monthly interest.

🔹 Borrowers must repay loans within the duration to avoid penalties.

🔹 Lenders can deposit funds into the lending pool to provid🔹 Lenders deposit funds into the contract to provide liquidity.

🔹 Lenders earn 3% monthly compounding interest and a 10% annual bonus.

🔹 Funds can be withdrawn anytime based on availability.

🔹 Borrowers and lenders both receive rewards at predefined intervals.e liquidity.

🔹 Lenders receive interest-based rewards based on their deposits.

🔹 Lenders can withdraw funds anytime, subject to availability.

🔹 Borrowers repay loans with interest to reclaim their collateral.

🔹 If a borrower fails to repay, their staked tokens are forfeited.

🔹 Defaulters are automatically blacklisted and cannot borrow again.

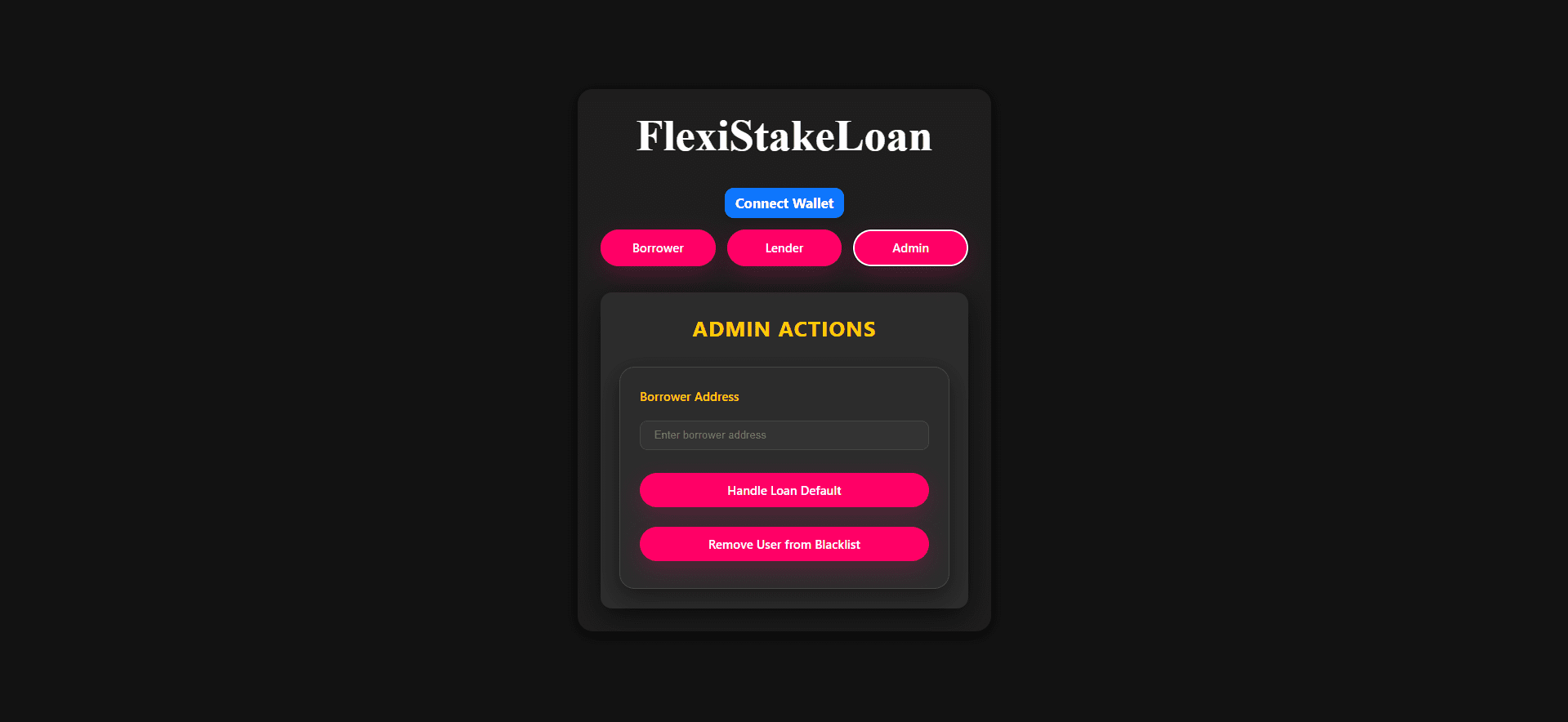

🔹 Admins can review and remove users from the blacklist if necessary.

🔹 Admins handle loan defaults by confiscating collateral.

🔹 The admin can remove blacklisted users if deemed appropriate.

🔹 Contract variables like interest rates and borrowing limits can be adjusted.

🔹 The system records events such as staking, borrowing, repayments, and withdrawals.

🔹 The contract ensures audited security before deployment.

🔹 Users must monitor loan durations to prevent forfeiture.

🔹 Future upgrades include cross-chain lending, dynamic interest rates, and customizable loan tiers.

🔹 Borrowers may get the option to set their own subscription-based lending models.