GroupFinance

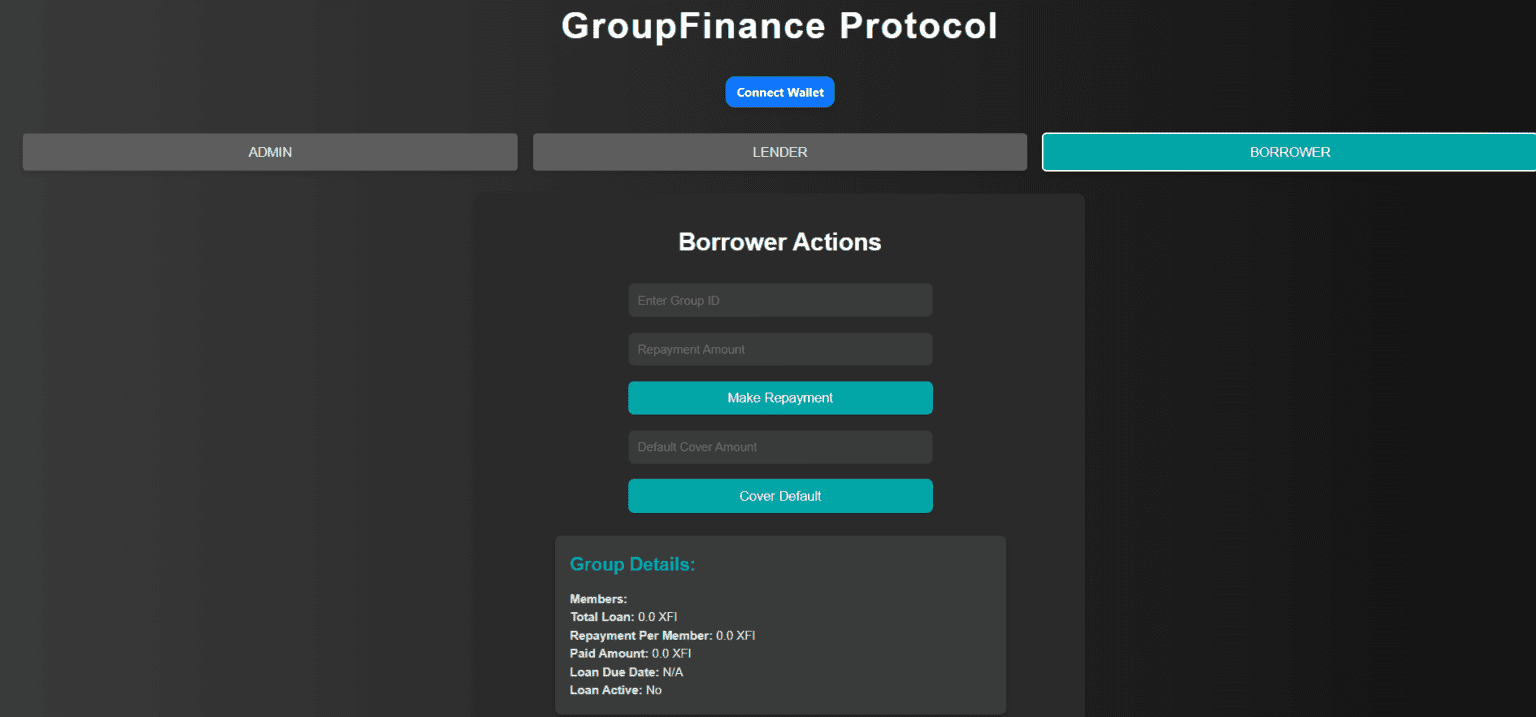

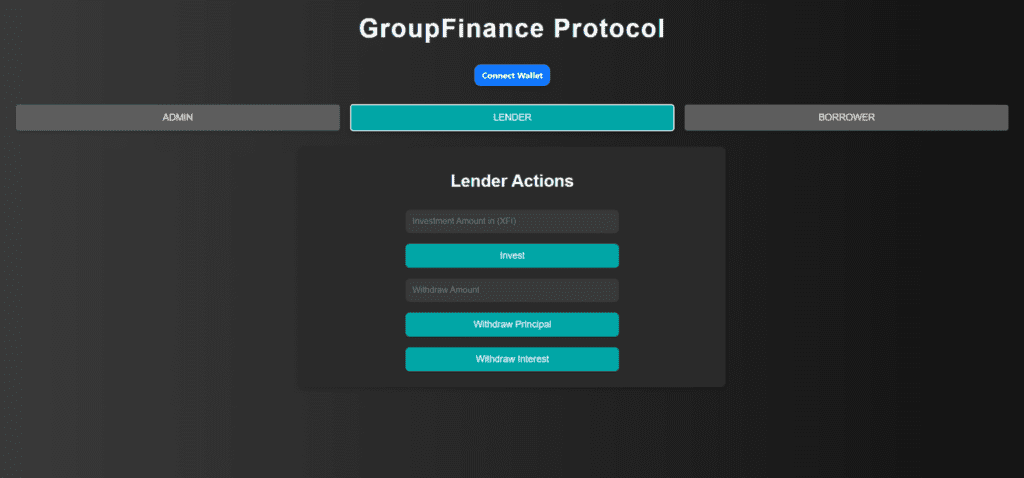

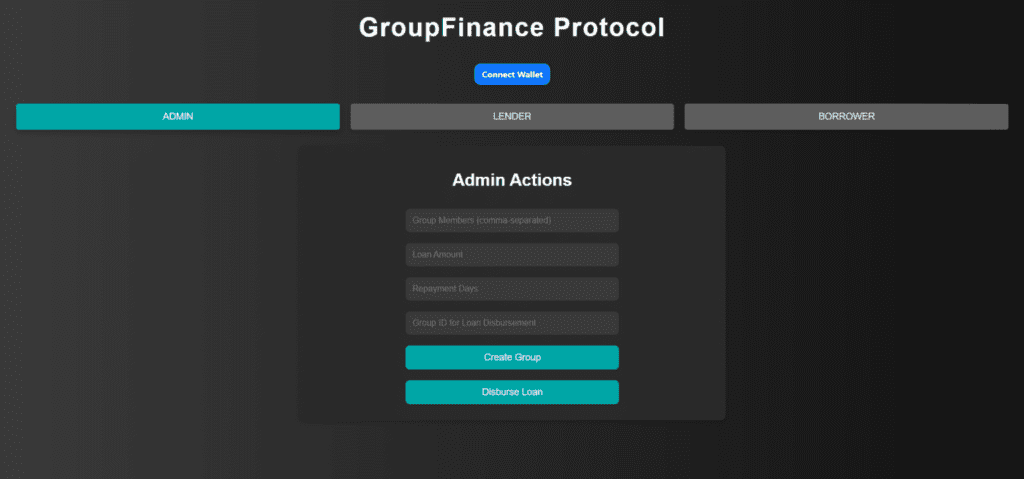

This contract is a decentralized group lending and borrowing system where borrowers collectively take loans and repay their shares, while lenders earn interest by investing. Key features include loan disbursement, repayment tracking, default handling, and a reward system for timely repayments. Admins manage group creation and defaults, and members can contribute to cover defaults. Lenders can invest, withdraw principal, and earn interest. Future plans include flexible repayment options, enhanced default mechanisms, and cross-chain expansion.

Subscription-Based Decentralized Lending: A Structured DeFi Solution

The Subscription-Based Lending smart contract offers a structured and transparent decentralized finance (DeFi) solution, combining a subscription model with traditional lending mechanisms. Borrowers gain access to funds by subscribing monthly, ensuring consistent lending activity and predictable repayment cycles. Lenders, in return, deposit funds into a lending pool and earn rewards based on the capital they provide.

This approach eliminates inconsistencies in repayments, penalties, and reward distribution, creating an automated and efficient lending system. Borrowers must maintain an active subscription to access funds, while lenders enjoy secured returns through predefined interest rates. The system further ensures risk mitigation with penalty mechanisms and admin-controlled borrower management.

How the Smart Contract Works: Loan, Subscription & Governance Model

The smart contract operates through predefined financial rules, ensuring smooth interactions between borrowers, lenders, and the system owner. Borrowers must renew their subscriptions monthly to remain eligible for loans. If payments are overdue, penalty fees are applied, and repeat defaulters may be blocked from further borrowing.

Lenders provide liquidity to the lending pool and earn monthly rewards based on the funds they deposit. The admin has control over borrower limits, penalties, and subscription adjustments, ensuring the system adapts to market conditions and remains secure.

🔹 Borrowers must pay a fixed subscription fee to access funds.

🔹 If borrowers fail to renew within the grace period, a penalty fee is charged.

🔹 Borrowers can only take loans up to a predefined limit.

🔹 Lenders can deposit funds into the lending pool to provide liquidity.

🔹 Lenders receive interest-based rewards based on their deposits.

🔹 Lenders can withdraw funds anytime, subject to availability.

🔹 Overdue repayments trigger automatic penalty fees.

🔹 Borrowers who consistently default may be blocked from borrowing.

🔹 Under certain conditions, admins can reinstate blacklisted users.

🔹 Admins adjust fees and borrowing limits as needed.

🔹 The admin can restrict or reinstate borrowers based on their history.

🔹 The owner can extract remaining contract funds when necessary.

🔹 Borrowers may set their own subscription tiers in future versions.

🔹 Interest will adjust based on market conditions.

🔹 The system will expand to multiple blockchain networks for broader adoption.