CrediChain

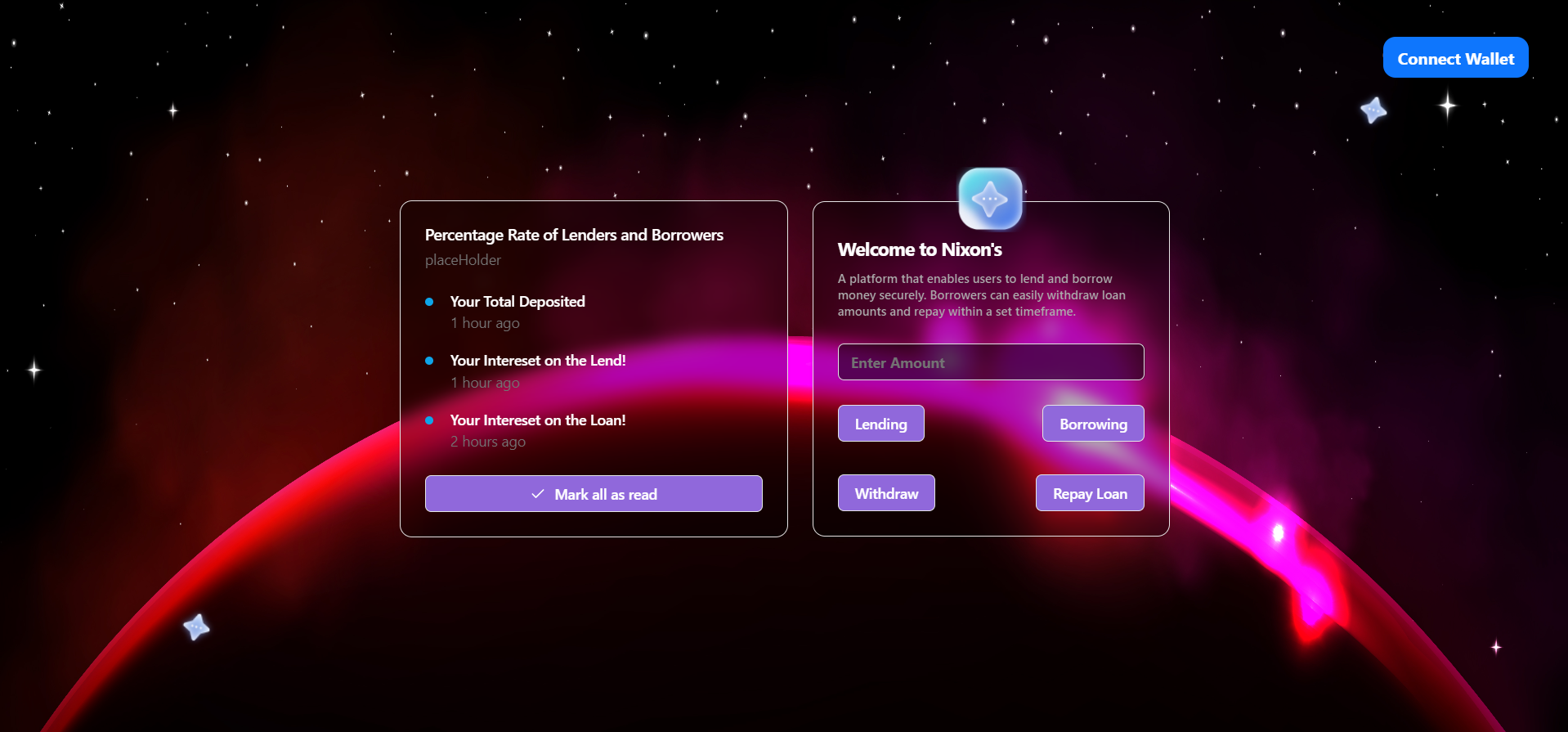

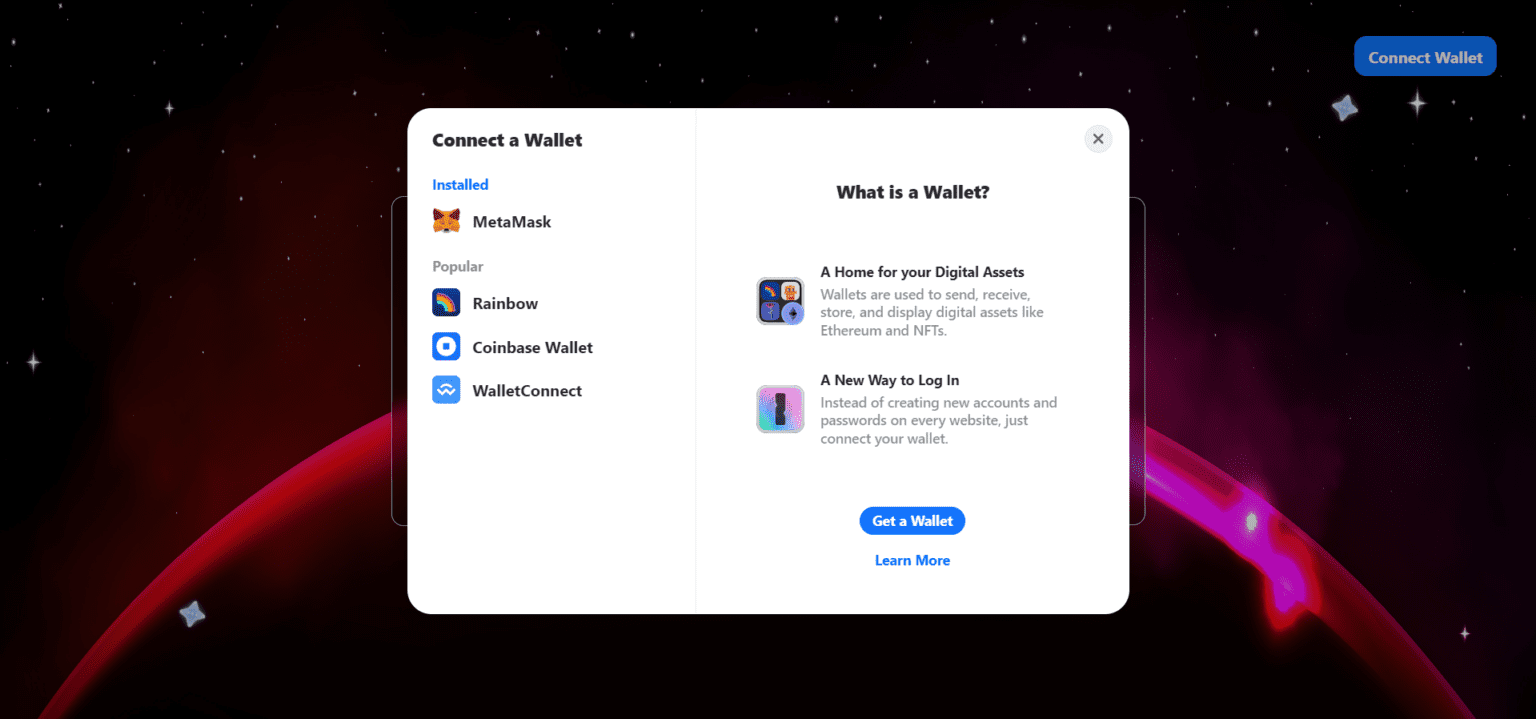

It is a decentralized lending and borrowing protocol built on the CrossFi blockchain, enabling peer-to-peer transactions without intermediaries. It features blockchain-based credit scoring, dynamic collateralization, and smart contract-driven risk management for secure, transparent, and fair lending. Users can borrow using digital assets, NFTs, or stablecoins, while lenders earn through direct loans or risk pools. The platform aims to revolutionize finance by making credit accessible, flexible, and decentralized.

Decentralized Lending Reinvented

CrediChain brings a new era to financial services by eliminating intermediaries and giving users direct control over lending and borrowing. Built on the CrossFi blockchain, the protocol allows seamless access to credit using digital assets, NFTs, and stablecoins. Its flexible system lets users negotiate loan terms while maintaining full ownership of their assets. CrediChain also introduces blockchain-based credit history, making loans accessible even without traditional credit scores. With smart contracts managing loan processes, users benefit from automation, transparency, and global reach. This peer-to-peer model empowers both lenders and borrowers to transact securely and efficiently.

Smarter Risk & Interest Management

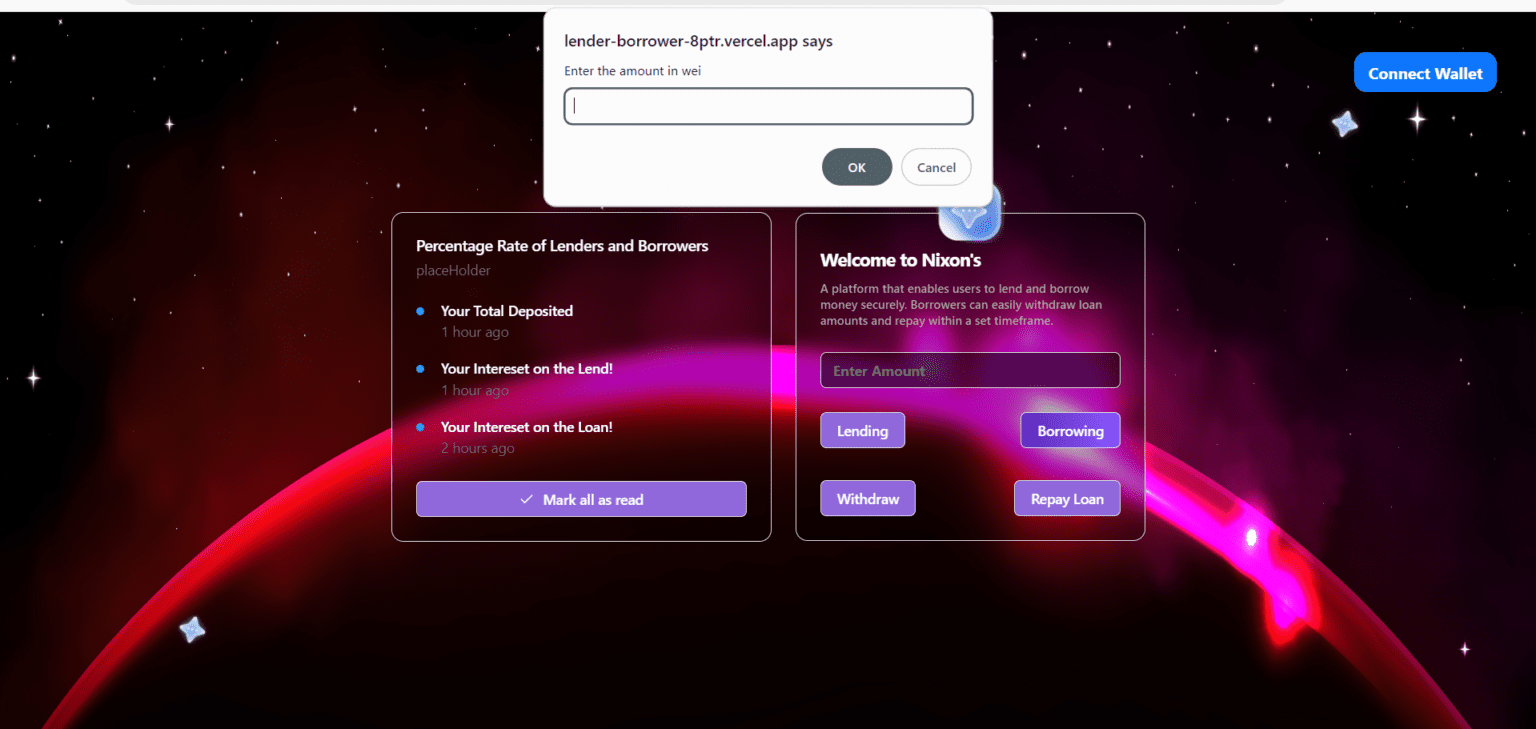

The platform integrates dynamic risk and interest management through advanced algorithms. It adjusts collateral requirements based on users’ decentralized credit scores and market conditions, allowing for fair and efficient asset use. Interest rates are algorithmically set, ensuring competitiveness while reducing risk. Lenders can join risk pools for added protection, creating safer investments and consistent returns. Borrowers, in turn, can purchase insurance to safeguard their collateral against liquidation. These innovations make CrediChain not only secure but also adaptive to user behavior and economic conditions, enabling more inclusive and resilient financial participation.

🔹 On-chain activity forms the basis for evaluating creditworthiness.

🔹 No need for traditional financial institutions or credit bureaus.

🔹 Smart contracts assess repayment behavior and platform interactions.

🔹 Credit profiles are secure, transparent, and decentralized.

🔹 Loans can be taken with a flexible collateral ratio.

🔹 NFTs, crypto, and other digital assets are accepted as collateral.

🔹 Collateralization adjusts according to the borrower’s credit profile.

🔹 Borrowers use their assets efficiently without over-pledging.

🔹 Lenders can join risk pools to minimize exposure to defaults.

🔹 Risk is shared across the pool, providing stable returns.

🔹 Borrowers may buy liquidation insurance for added safety.

🔹 This dual-layer protection strengthens overall platform security.